Maximising Your Brand’s Impact: YouTube’s Latest Advertising Formats for Big Screen Success

You will probably already be familiar with the Youtube library of advertising formats – the non-skippable 15-second ads, the skippable longer formats and the 6-second Bumper ads. Well new to the fold just released at the latest Brandcast event is the 30-second non-skippable.

What’s the big deal? Well, we think it could really propel the AV offering further, positioning it as a major player in the big screen landscape. This format is more aligned to the traditional linear stations where wastage is high and targeting options to the level offered by Youtube are limited.

We see it as an exciting extension for direct response television (DRTV) campaigns – where audience targeting is better and costs without wastage built-in stack up nicely but also brand in segment-based campaigns where incremental BVOD costs on the major stations make incremental reach an expensive option. As it’s so early YouTube has not revealed what the minimum spend or CPMs will be, but we would expect them to be way lower than the current market competition.

In addition to this innovation, YouTube has also developed its own ‘pause screen’ page option first used and inspired by Hulu but more commonly seen in the UK on Channel 4 VOD. Interestingly 70% of YouTube’s current impressions are on TV screens. Again no costs have been shared for this but it will be interesting to see how they compare against the likes of channel 4.

Whether you’re seeking efficient reach with minimal wastage, or to increase your response volume at a low CPA on DRTV, our team has likely already tested this for you! Speak to the team to find out how we can integrate these exciting formats into your campaign.

IPA Bellwether report 2023 Q1 – light at the end of the tunnel?

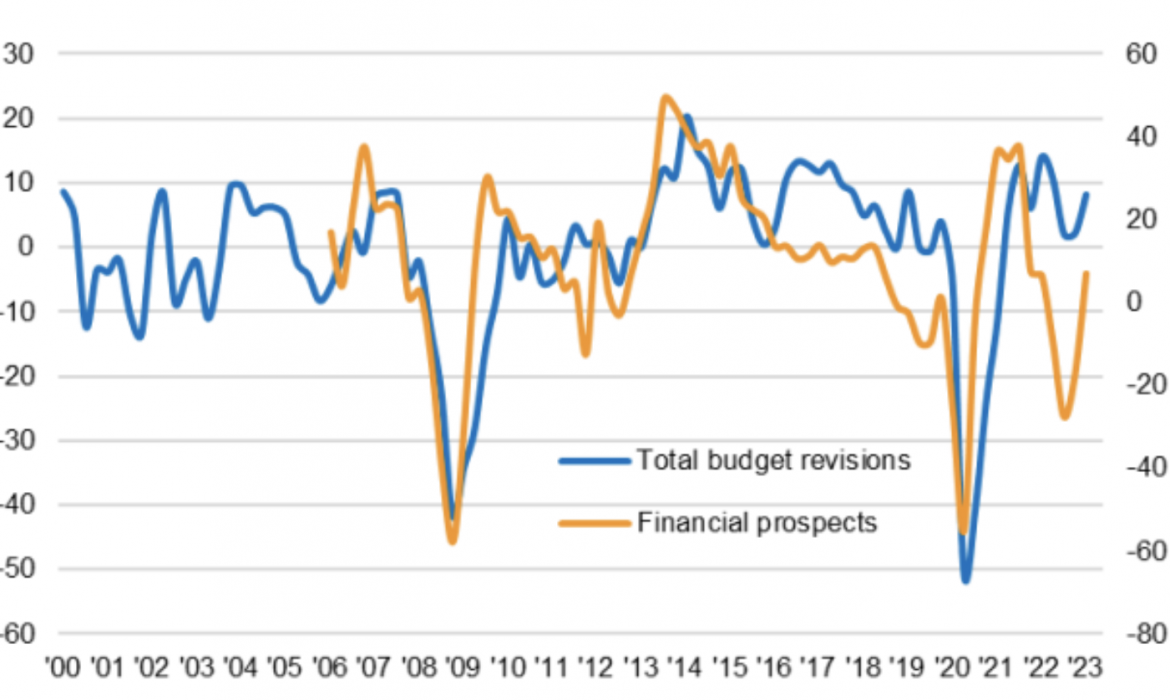

Signs of hope from the latest IPA report after periods of pretty bleak outlooks. Whilst most of the UK PLC is recognising the cost of living pressure it seems to be meeting this head on with media marketing growth (see chart) and in particular sales promotion to boost sales demand.

The Chart shows revisions to total marketing budgets

This is all great news given that it’s the first positive response since 2021 and optimism can breed more positive sentiment however this is all tempered a little by the sentiment around the wider financial situation which while better is still negative.

We have seen ourselves a recent uptick in client testing and outlook but the wider economic view will probably remain at a lower level until the inflation rate is brought back into line. It’s looking better though and we are heading into summer too!

Comscore Digital Rankings for United Kingdom

Comscore’s Digital Rankings for the United Kingdom have been updated with March data. Here you will find the top 20 sites that rank for reach, total unique visitors and the total minutes spent on that site.

It gives us a great insight into a generalised view as to what UK is doing – it also helps us understand where inventory may be in excess to create real value buying opportunities on our programmatic platform.

You’ll be sure to find the top 3 sites on most of our performance campaign plans at OptiComm, they can deliver volume and targeting, but there is real opportunity elsewhere – and the recent performance on Sky sites from our clients has been exceptional. As Comscore shows it gets great reach and minutes on site meaning pricing is advantageous..at the moment!

|

Property |

Total Unique Visitors/Viewers (000) |

% Reach |

Composition Index UV |

Total Minutes (MM) |

Average Minutes per Visitor |

|---|---|---|---|---|---|

|

Google Sites |

56,390 |

98.1% |

100 |

70,710 |

1,254 |

|

Microsoft Sites |

50,845 |

88.5% |

100 |

6,619 |

130 |

|

|

47,271 |

82.2% |

100 |

33,112 |

700 |

|

Amazon Sites |

46,758 |

81.4% |

100 |

7,650 |

164 |

|

Reach Group |

43,809 |

76.2% |

100 |

1,991 |

45.4 |

|

News UK Sites |

38,359 |

66.7% |

100 |

1,009 |

26.3 |

|

BBC Sites |

36,720 |

63.9% |

100 |

3,295 |

89.7 |

|

Yahoo |

35,720 |

62.2% |

100 |

3,415 |

95.6 |

|

Apple Inc. |

32,388 |

56.4% |

100 |

2,898 |

89.5 |

|

eBay |

31,193 |

54.3% |

100 |

2,691 |

86.3 |

|

Ziff Davis |

30,757 |

53.5% |

100 |

188 |

6.1 |

|

Mail Online / Daily Mail |

29,764 |

51.8% |

100 |

918 |

30.9 |

|

WWW.GOV.UK |

26,854 |

46.7% |

100 |

168 |

6.2 |

|

Wikimedia Foundation Sites |

26,378 |

45.9% |

100 |

432 |

16.4 |

|

|

25,975 |

45.2% |

100 |

3,579 |

138 |

|

Spotify |

24,972 |

43.5% |

100 |

29,109 |

1,166 |

|

PayPal |

24,920 |

43.4% |

100 |

319 |

12.8 |

|

The Guardian |

24,819 |

43.2% |

100 |

532 |

21.5 |

|

Sky Sites |

24,104 |

41.9% |

100 |

1,011 |

42 |

|

Hearst |

23,735 |

41.3% |

100 |

123 |

5.2 |

For more detail please visit the rankings page for the full table, along with additional countries / platforms.

If you would like to get more information and or onto these sites please get in touch