Maximising Your Brand’s Impact: YouTube’s Latest Advertising Formats for Big Screen Success

You will probably already be familiar with the Youtube library of advertising formats – the non-skippable 15-second ads, the skippable longer formats and the 6-second Bumper ads. Well new to the fold just released at the latest Brandcast event is the 30-second non-skippable.

What’s the big deal? Well, we think it could really propel the AV offering further, positioning it as a major player in the big screen landscape. This format is more aligned to the traditional linear stations where wastage is high and targeting options to the level offered by Youtube are limited.

We see it as an exciting extension for direct response television (DRTV) campaigns – where audience targeting is better and costs without wastage built-in stack up nicely but also brand in segment-based campaigns where incremental BVOD costs on the major stations make incremental reach an expensive option. As it’s so early YouTube has not revealed what the minimum spend or CPMs will be, but we would expect them to be way lower than the current market competition.

In addition to this innovation, YouTube has also developed its own ‘pause screen’ page option first used and inspired by Hulu but more commonly seen in the UK on Channel 4 VOD. Interestingly 70% of YouTube’s current impressions are on TV screens. Again no costs have been shared for this but it will be interesting to see how they compare against the likes of channel 4.

Whether you’re seeking efficient reach with minimal wastage, or to increase your response volume at a low CPA on DRTV, our team has likely already tested this for you! Speak to the team to find out how we can integrate these exciting formats into your campaign.

It’s 2023, so what’s in store for Media Land?

It’s already looking like an interesting year in media, with a host of exciting, new developments – not least of which is the fact that there will be advertising on Netflix for the very first time!

Here at Opticomm we’ve got together to pool our thinking and provide you with a clear outline of what we might expect to see, media channel by media channel.

We think you’ll find it offers you and your business real food for thought…

Print –

Unsurprisingly, circulations (when publishers are even willing to publish them!) are still decreasing – even in the once-buoyant free-sheet market.

We expect to see a marked increase in subscription marketing from all of the major media owners and, like it or not, paywalls are almost certain to become standard. We may even be saying goodbye to free content from the Guardian and the Daily Mail.

But that doesn’t mean that value can’t be created; there has been a remarkable centralization of the sales process. For example, the Daily Mail team now sell the Telegraph group and press inserts have been all-but entirely centralized across all of the major national press titles.

Here at Opticomm, we have started to recognize this, creating some excellent, specific deals. In addition, the short-term market is still a fertile hunting ground for those who want to squeeze maximum value from the medium.

The much-heralded move by media owners to create ‘joined-up digital and print’ has yet to really pay off – and without a meaningful link between the two channels in customer use and the way that client/agency teams work, any progress will be an uphill challenge.

In the world of magazines, the picture is very similar to what find in the national press – circulations are declining and there is an increased effort to sell a joined-up print and digital offering. We shall have to wait and see whether this initiative bears fruit.

Despite the many challenges, some specific sectors do remain attractive for tailored activity -and sometimes joined-up digital and print packages can make sense, depending on your specific objective. We’re always on top of the latest developments so please do talk to our print team about your objectives.

Cinema –

We are going to go out on a limb here, and say that if you’re looking for maximum impact, now is a great time to use the most immersive and impressive audio-visual format available in the world today.

Whilst reach is expensive in cinema, targeted and tailored-by-film options are definitely worth looking at as the sector begins to find its post-covid feet again. AGP packages where the audience delivery is guaranteed are now working to similarly BVOD costs and delivery can offer a real advantage in impact. This year sees several blockbusters – Indiana Jones 5, John Wick 4, Dune Part 2, Creed 3, Little Mermaid (real world!) and Oppenheimer to name just a few. If there’s a match with your product and target audience, cinema is certainly something you might want to talk to us about

TV –

Welcome to a world of fragmentation!

In recent years, we have seen increasing fragmentation and 2023 will be no different. TV is, quite simply, no longer the domain of the 16 – 34-year-old viewer, as more and more people of all ages are now turning to Video On Demand and CTV channels.

The world of VOD looks to be the area where we will see the most real change and development. In fact, if there is the level of investment we expect, we may see VOD grow to get the coverage it needs to stand alone… though that day may still be a long way off.

From an advertising perspective Netflix have just started their first forays into advertising and we expect Disney+ to follow suit. Their biggest issues, of course, will be how to price their offerings, to both advertisers and subscribers.

One thing we at Opticomm are really excited about is the potential additional audiences that CFlight are planning to introduce (currently it’s just for adults). It allows us to see the incremental impact of combining VOD with linear TV advertising – and that will be vital in proving the value of the platforms in isolation or in combination.

In addition, with more and more issues tracking digitally, we expect to see an increase in properly addressable TV. We have been building a wealth of customer data and can accurately pinpoint even the most niche audiences while using broadcast platforms. Even the traditional linear Channels are moving to addressable content first, with the likes of ITV revamping their hub last year to ITVX where they are beginning to launch Big Name shows which will only be available exclusively on the platform for at least six months, in a bid to draw more audiences to their digital platform.

Even when we take all this change and development into account, linear TV is still the best platform for driving big audiences at key moments – and with two new series of both Love Island and I’m A Celebrity this year – ITV will certainly be hoping for a bumper year!

Social –

Social trends

As the army of creators gather, growth in influencer marketing and brand partnership is now becoming a crucial element of any intelligent media plan.

Social commerce harnessed this well last year, but we should expect to see non-e-commerce brands getting in on the act throughout the months to come.

The ‘Cookie Apocalypse’ continues whilst people get back on their feet with server-to-server tracking. This should really be at the top of every marketer’s to-do list – even more so since Meta might well ‘sunset’ pixel tracking – causing further disruption to advertising on social.

The battle of the creative work generated by humans versus that produced by AIs is really heating up – and will get even hotter as more open AI resources become available.

Do we think this will be good for our industry?

“Yes!, AI and the world of automation should be used to help you deliver the everyday mundane tasks that can be automated – giving us more time to plan and be more creative”

Sanjeev Patel, Opticomm

Display –

One of Opticomm’s top insights this year is that he agility and scale that display advertising can deliver could create a massive upsurge in the use of this medium.

As TV viewing habits change dramatically, we will see more and more people deciding to stream their TV programmes – and therefore the CTV ad space will almost certainly experience ever-higher demand.

This context almost certainly means that Digital Out Of Home and Audio channels will experience significant growth in both capability and inventory – and that can only be great news for advertisers seeking scale.

As in the world of social media, the ‘Cookie Apocalypse’ will continue to have a tremendous impact, but more and more marketers have already made the very sensible decision to grow their first-party data.

Those who haven’t may well find that the journey to get back on their feet takes a little longer.

With so many advertisers flocking to display due to the tracking issues inherent in the use of social, we are sure to see higher demand for creative formats that generate better, longer-lasting user engagement

Search –

‘Incrementality Testing’, the upcoming trend in Google Search is something we all need to focus on this year.

With post-covid marketing budgets shrinking in comparison with 2019, the need to measure the effectiveness of campaigns in terms of conversions is more crucial than ever.

Incrementality testing allows you to determine the number of conversions that are directly attributed to a user’s exposure to your ad, by ignoring conversions that would have happened regardless of any campaign activity.

The Cookie-less future of search is gearing up towards modeling systems that can ‘Fill the gaps’.

It will be imperative for brands to set up server-side tracking and to future-proof their efforts.

Shopping behaviour is constantly changing, and now the dust seems to be settling on a post-covid world.

Black Friday saw a 200% increase in sales. And as the cost of living crisis continues to erode brand loyalty, and people search for cheaper options, the number of touchpoints will increase – making it all the more important to intercept the ‘purchase journey’ at the earliest possible point.

Audio –

The latest Rajar figures show these are exciting times for Commercial stations – they overtook BBC in the third quarter with 38 million people listening every week in quarter four. Here at Opticomm we don’t think this is just a ‘blip’ n- and we don’t think this new reality is likely to change any time soon.

The expansion of Greatest Hits Radio has also helped to drive the growth of Commercial – with more transmitters and the continuing expansion of existing networks. Add the fact they have got Radio 2’s Legendary Ken Bruce coming on air in April – and we can only expect a further surge in weekly listeners and more numbers stolen from the BBC.

Digital elements have also been a powerful driver in the growth of commercial radio. Sales of Smart Speakers continue to grow and now account for a healthy 14% of total share. They also now account for 24% of total online radio listening.

This trend is sure to continue in 2023 and we wouldn’t be surprised to see significant increases by Q4 2023. Bauer reports that more than 75% of its audience listen via a digital device!

In addition, we expect dramatic growth from the ever-improving territory of podcast listening.

This is a juggernaut that shows no signs of slowing down!

Finally, we are looking forward to even more developments in creative ways of reaching people – from Voice Interactive campaigns to utilizing companion banners that will allow for clicks from ads that are served on the digital platforms. We anticipate far more efficient tracking and believe we will be able to prove the value of radio within the context of a hardworking performance campaign

Outdoor –

Alongside cinema, outdoor activity is starting to see a meaningful recovery from the effects of the pandemic and, in fact, has experienced even greater advertiser demand.

The move to digital formats is a continuing and growing trend. A great example of where this may make a real difference is in the use of train card panels – where the cost of production is expensive – almost prohibitive.

We are also witnessing the emergence of tailored digital beyond the standard. We are now able to look at sites where the ad changes when the temperature drops – and there have been significant developments in sophisticated video recognition techniques. For example, at sites experiencing heavy vehicular traffic, we can serve creative work against car brands that stop at nearby traffic lights. Other developments we expect to see are high-impact 3D creative executions and other options that dramatically increase noticeability.

With media owners already rolling out new ways of attracting consumer attention, – we are expecting production costs to decrease and these new formats to become increasingly affordable.

These are our thoughts on the media landscape for 2023 and beyond, if you’d like to discuss any of these channels with the Opticomm team, please get in touch and we’ll be delighted to share our insights in greater detail. We’re looking forward to working with you!

Can the TV advertising market ‘chill’ with developments over at Netflix?

Opticomm’s Broadcast Director Nicky Legg takes a look at developments in the fast moving VOD market and how it might affect the TV market.

Anyone who has a Now TV subscription will recall last year’s sudden change and ‘experiment’ with ad placement into content streams. While this can be negated at a cost, it looks like the hybrid model is here to stay and is being considered even by the most fervent anti-ad services…namely Netflix. Netflix CEO Reed Hastings told his employees just after their first quarter report that this model could in fact be with us by the end of the year.

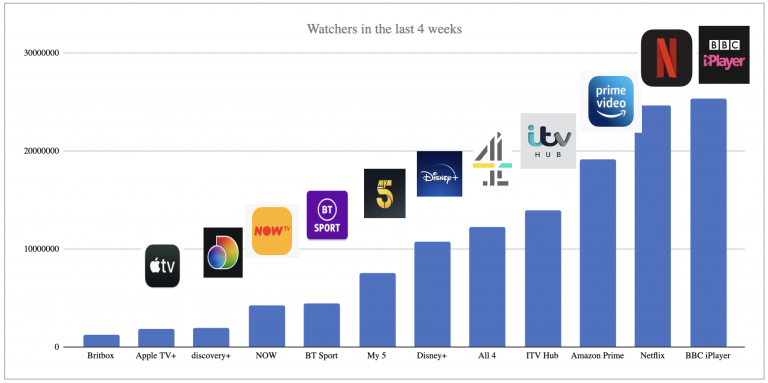

So why is Netflix looking at it such a big deal? Namely its sheer size! (see fig1)

The business model Netflix moves to and the level of targeting possible will really dictate what effect it will have. The challenge to broadcast linear activity is probably a distant one despite the reach capabilities, when compared to linear CPT’s even on ITV prices, which are likely to be twice to three times the cost per thousand for large broadcast audiences. By adding a video reach capability to Netflix users who don’t watch linear TV, a demonstrable effect may be feasible.

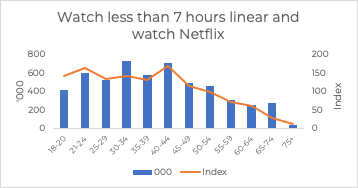

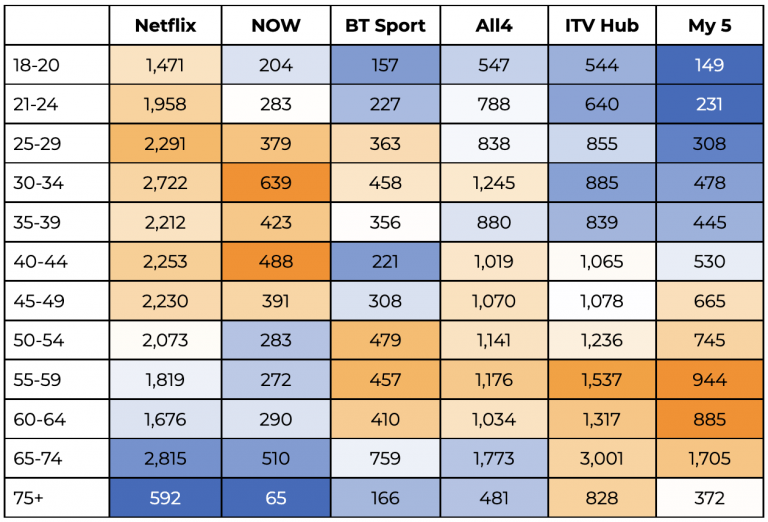

It’s clear there is a real difference and opportunity when it comes to age. Targeting older audiences at volume for reach and awareness goals will be much more efficient than using more traditional linear channels and models. However for younger audiences, if Netflix can hold their audience reach, integrate advertising and get a competitive price they may just have the magic key. No other commercial provider can come close to their reach and even older audiences only deliver more in the 65+ market. (see fig3)

While it appears that VOD providers have nothing to relax about, if you are targeting 20-45 year olds you can anticipate chilling just a little bit.