Business as unusual

We don’t want to add to the noise but we thought a top-line view from what we see across media markets in the UK may be beneficial…

Interesting to note is that people are still buying remotely, as anyone who has tried to buy any form of home gym equipment will testify!

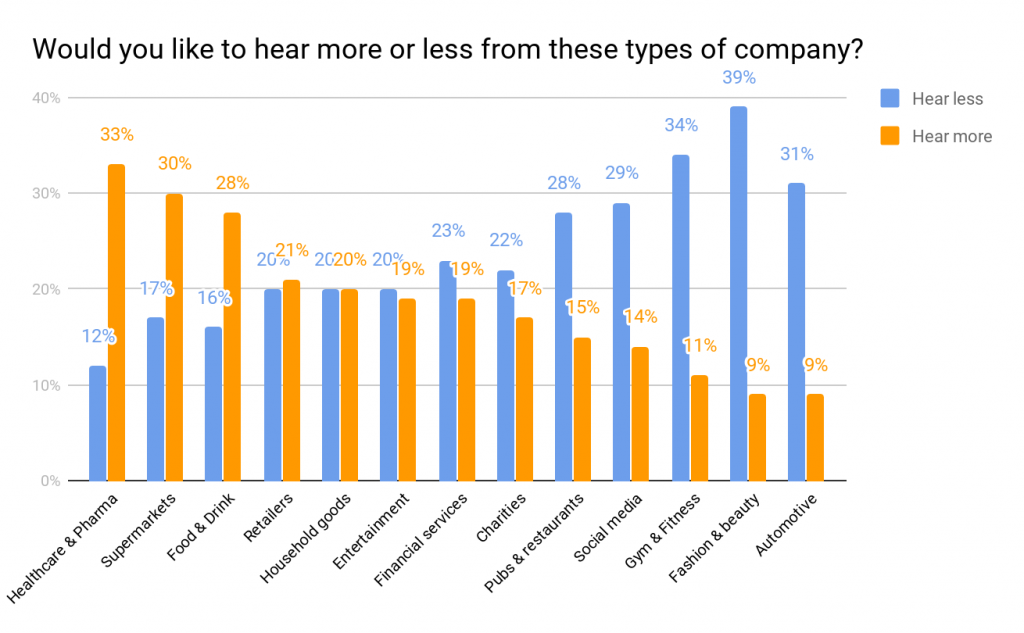

Research from Opinium also shows consumers are still thinking about their consumption and happy to hear from even the long distant memories of pubs and restaurants…

So for the media news as it stands, here and now, the headlines across the media channels spectrum (if you’d like more detail on a particular channel or elements let us know). No surprises the big winners are all in home…

TV

TV is seeing unprecedented levels of viewing across the board – Adult viewing is up 17% and ABC1 adults up 20%. What is interesting is that more and more people are tuning into ITV with viewing up 22% for adults and 29% for ABC1 Adults!!

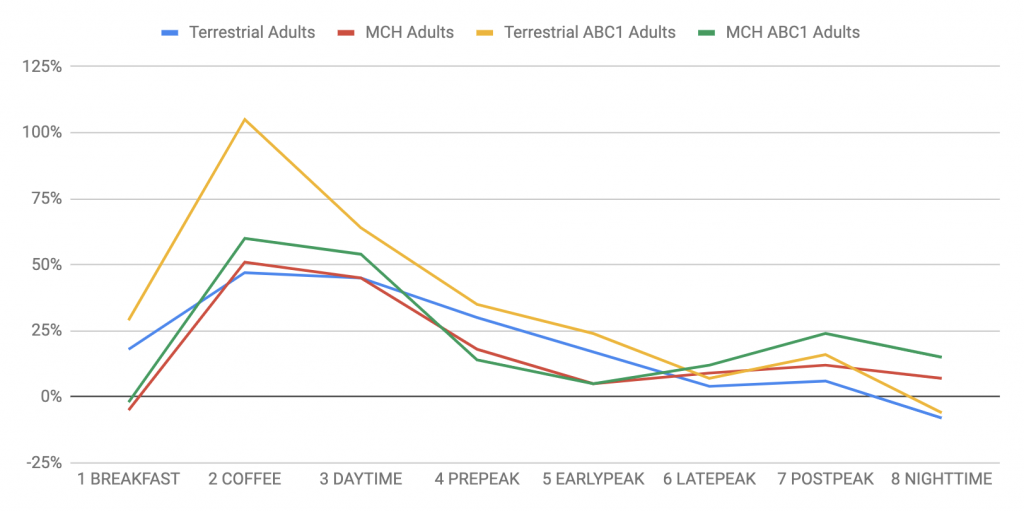

The majority of increases are coming during the day – with ABC1 Adults growing by 105% in the coffee segment (925-1125am) on terrestrial as you can see in Fig 2

Below – % change in viewing 4 weeks to 12th April 2020 vs 2019, BARB UK Data

While peak viewing is also up the change is not quite so significant it is all still up year on year. The only drops come from breakfast and night time.

It appears that in the evenings people are turning to streaming services – with All 4 reporting a 48% increase, Sky VoD was up by 50%! Netflix don’t publish viewing figures very often but we would hazard a guess of significant increases – particularly in the evenings as we all look for new programmes to binge watch! What a time for Disney+ to have launched in the UK!

All this viewing, not forgetting advertisers cancelling campaigns, is driving great value for our clients, not only on linear TV but also on VOD services. CPT’s are lower than they have ever been

Radio

The next RAJAR is not out until May, however we are starting to see some early signs that radio listening is spiking as people are more home based. Surveys by Global and Bauer have both shown between 17%-30% increases in listening time. Obviously one effect has been to lower drivetime listening – a real benefit to campaigns planned for daytime only. One thing we have seen is that radio auctions are delivering some of our clients real value with CPTs never seen before. In other audio channels, the upswing by podcasts continues with an alternative to wall to wall news on Covid on more traditional audio formats and provides a useful way of marrying content and advertising in context.

National Press

Up to February was looking downbeat on circulations from a stable base across the previous 4 months. With latest ABC’s out today the picture shows that national press circulations have actually held up pretty well and some have even seen increases into the March period ( with some gains for Guardian and, Times and Sunday Express and Sunday Times.)

Magazines that have high subscribers are doing really well – we expect newsstand based titles to see some dips- although there is alot of value in some of the deals we are doing at the moment even with potential big decreases! We won’t get full circulations changes until after mid year.

Outdoor

With lockdown Out of Home impacts are through the floor – added to that there will be no roadside advertising posted throughout April – and minimal rail. However, some light in the outdoor darkness is provided by pharmacies and supermarkets formats and there are some great deals to be had there.

One potential issue coming down the road is supply and demand for Q3 and Q4 – these are in demand months anyway and with most campaigns delayed, pressure is likely to be on – especially all printed traditional routes. Our best advice is to plan any later year activity early and be ready to buy as soon as the market picks up.

Digital Display

With a lot of time on everyone’s hands for endless web browsing we’re seeing supply of digital impressions up 8% week on week – with demand from advertisers staying relatively static this has pushed down CPMs, creating a lot of value across the marketplace.

One trend across display is that some advertisers are blocking main publisher websites, as they do not want to be associated with Covid-related news – meaning premium inventory is available at a low cost.

It’s not all doom and gloom…..

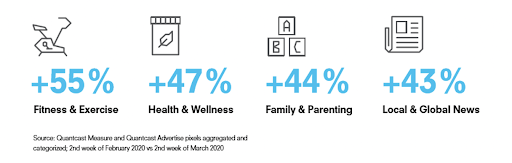

We’re seeing a positive trend across health, fitness and family – we may come out of this with a healthier, happier nation.

Paid Social

Following the Government’s advice to stay in touch with your family and friends via social media we have certainly seen that happen in user behaviour on social.

Snapchat are reporting a 50% increase in video calls vs February, whilst Facebook have developed a desktop video call due to the demand seen across other conferencing platforms – this means we’re likely to see more desktop inventory available which often sees great conversion rates.

With the increased volume of traffic we’ve seen CPMs drop 57% since Q4 last year (which is a particularly expensive time of year) – offering great opportunities for testing.

Everyone’s new favorite app TikTok continues to take the world by storm – becoming the most downloaded app worldwide during February. In a time when people want more and more content to keep themselves and their friends entertained, TikTok is the place to find it.

It’s not just “the kids” using it – research shows that the 55+ market are the second most active spending 56 minutes per day within the app, finding ways to engage with the rest of their family remotely.

Cinema

Not much to say other than with no cinemas open there isn’t a media market. The largest UK media owner DCM is running a skeleton staff and awaiting news of when lockdown ends.

Some big releases already delayed include Bond (No Time to Die) and Fast and Furious 9 – let’s hope Minions 2 – The Rise of Gru, slated for 10th July, doesn’t get on the list!

Royal Mail are still delivering and that means both direct mail and door drops remain viable media channels. The service is fluctuating depending on the postman status but running at 98%! Door drops are still being delivered and it looks like demand is back to where it was.

Possibly a good time to consider given the excitement the arrival of post brings these days!

Summary:

In the short term its all about TV and digital/paid social. However we expect to see a bit of pressure on outdoor availability and probably sooner than most expect.

For the medium to long term TV markets are likely to suffer from loss of ABC1 peak share to streaming services – this ironically could mean some inflation but not in DRTV market where we think value is getting better and better.

Related Posts

Flipping the funnel – B2B

We all know about 'the funnel', it has always been a useful mindmap in marketing for both its ease and universality but here at Opticomm we have found the traditional funnel from a vertical top to bottom...